Forex Crunch GBP/USD Bounces Off Support Line on Meeting Minutes |

- GBP/USD Bounces Off Support Line on Meeting Minutes

- EUR/USD Aug. 18: Euro Gradually Sliding Down

- Forex Daily Outlook – August 18 2010

- Forex SMS Alerts – Mobile4X Review

| GBP/USD Bounces Off Support Line on Meeting Minutes Posted: 18 Aug 2010 01:41 AM PDT The meeting minutes from the last meeting of the BoE showed that there’s still one member voting for a rate hike. This helped GBP/USD bounce off the support line, after it got very close to it. Update on the Pound. Andrew Sentance continues to vote for a rate hike. He’s still the only member out of 9 that wants a rate hike, but his voice is heard. The Pound leaped from 1.5545 to 1.5610 immediately after the release, and the move isn’t over: Update: As of 9:45 GMT, GBP/USD already reached 1.5660! Very strong move.

A continued move could send the pair back to 1.5720, an area it failed to break yesterday. Above, 1.5833 and 1.60 are the next levels of resistance. Earlier this week, British inflation continuing falling, slowly returning to the target range. CPI still stands on 3.1%, but Core CPI fell sharply to an annual rate of 2.6%. Mervyn King, the governor of the BoE, expressed “surprise” from the higher inflation, but remained certain that it will fall. He reiterated his stance that the high prices are mostly the result of higher taxes. The Pound struggled after this release, but later fully digested the news and dropped from the vicinity of the 1.5720 resistance line all the way to the other end of the spectrum – the 1.5520 support line. It opened the London session with an attempt to break lower and pushed forward after the MPC Meeting Minutes. A new move downwards, would send the pair first to support at 1.5520, and then to 1.5470 and 1.5350. Want to see what other traders are doing in real accounts? Check out Currensee. It's free.. |

| EUR/USD Aug. 18: Euro Gradually Sliding Down Posted: 18 Aug 2010 12:16 AM PDT Yesterday’s weak ZEW Economic Sentiment figure erased the optimism that came on the successful bond auctions. The result – no breakout. The pair now slips within the range. Will it threaten the support line?

EUR/USD Technicals

EUR/USD Fundamentals

EUR/USD Sentiment

Note – This is a new and still experimental section on Forex Crunch. It’s still in development. Want to see what other traders are doing in real accounts? Check out Currensee. It's free.. |

| Forex Daily Outlook – August 18 2010 Posted: 17 Aug 2010 02:00 PM PDT Some existing News in New Zealand regarding the PPI Input, in the US updates regarding the Crude Oil Inventories and more. Let’s see what awaits us today. In Great Britain Monetary Policy Committee Meeting Minutes, It’s a detailed record of the Bank of England (BOE), MPC’s most recent meeting providing in-depth insights into the economic conditions that influenced their vote on where to set interest rates, and offering clues on the outcome of future votes.

In the US, Crude Oil Inventories, the number of barrels of crude oil held in inventory by commercial firms during the past week stabilizes on -3.0M. It influences the price of petroleum products which affects inflation, but also impacts growth as many industries rely on oil to produce goods. For more on USD/CAD, read the Canadian dollar forecast. In Australia, Melbourne Institute (MI) Leading Index, the level of a composite index based on 9 economic indicators is 0.2%. More in Australia, Wage Price Index, the price businesses and the government pay for labor, excluding bonuses is 0.9, when businesses pay more for labor the higher costs are usually passed on to the consumer; For more on the Aussie, read the AUD/USD forecast. In New Zealand, Producer Price Index (PPI) Input the price of goods and raw materials purchased by manufacturers. When manufacturers pay more for goods the higher costs are usually passed on to the consumer stabilized on 1.3% and the PPI Output, the price of goods sold by manufacturers (Only includes goods produced domestically;), is stabilized on 1.8%. That’s it for today. Happy forex trading! Want to see what other traders are doing in real accounts? Check out Currensee. It's free. |

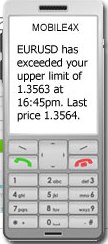

| Forex SMS Alerts – Mobile4X Review Posted: 17 Aug 2010 08:09 AM PDT Mobile4X is a new services that provides custom real time SMS alerts on forex rates. The free service can be set send alerts on a time basis or upon a breach of a technical level. Here’s a review. Mobile4X was developed by Peter Blaikie, who wanted to relieve forex traders of their habit to attach their nose to the screen, as most traders also have a day job and everyday life. Back in 2007, he began developing this system, which is not signal based. The system can be used in various ways: You can set up to two price-based alerts per currency pair and three timely updates a day. The currencies that are supported are USD, EUR, JPY, CHF, GBP and AUD. The service also works on demand – you can send an SMS or an email to the system, and receive a prompt answer, as many times as you want. A full manual is available here. Everything can be managed through the web interface as well. The service is basically free, and the only costs are for the text messages, depending on your carrier. Mobile4X has local access numbers in the US, UK, Australia and New Zealand, which make it cheaper for sending text messages. As for receiving messages, the service is already supported in 180 countries. Very impressing. I’ve tested the service in various ways and found it to be quick and accurate. My phone immediately notified me on a new message when price moved out of range, or when I asked for a quick market update.

What’s missing in this service for me is support for the New Zealand dollar, which is significant currency that should get the deserved attention. An expansion of local access numbers to other countries will also be useful for traders that want to get updates on demand. This service can free traders not only of staring at their forex charts for hours, but also free them of signal providers, which send updates only for buy / sell signals, and don’t enable custom alerts for forex exchange rates. Want to see what other traders are doing in real accounts? Check out Currensee. It's free.. |

| You are subscribed to email updates from Forex Crunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment