Forex Blog |

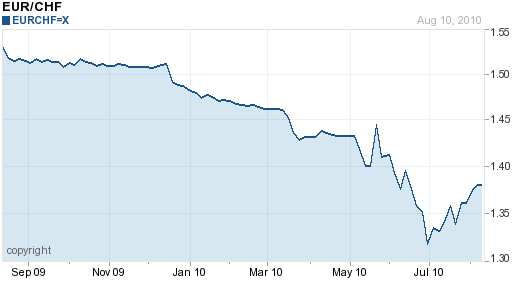

| SNB Leads Downward Pressure on Euro Posted: 12 Aug 2010 12:18 AM PDT Since the beginning of this week, the Euro has retreated 3% against the US Dollar, including a 2% dip in Wednesday’s trading session, alone. Is it possible that the Euro rally was too good to be true, or is this correction only temporary?

As an aside, the kinds of back-and-forth swings that have become commonplace in forex markets may be attributable to large-scale investors, such as Central Banks. As currencies (or other securities, for that matter) decline, investors will often take advantage of low prices and enter the market. When prices rise, these same investors (joined by long-term investors) will often take profits and sell. As a result, it is hard for currencies to rally continuously without any kind of correction. Back to the Euro, there are a handful of Central Banks who are making their presence known on this front. On several occasions over the last few weeks, the Central Bank of Switzerland (SNB) has unloaded massive quantities of Euros. If you recall, the SNB amassed nearly €200 Billion over the previous year, as part of a massive buying spree aimed at holding down the value of the Franc. Given that the Franc has appreciated by more than 15% against the Franc this year, it’s perhaps unsurprising that the SNB is throwing in the towel. (Oddly, it waited until Euros were cheap before it started selling). Analysts from Morgan Stanley foresees a similar trend: “Central banks are likely to let their euro holdings slide as a percentage of the total, reflecting lingering concerns about the euro zone’s fiscal outlook…’We do not expect that central banks will provide as much support for euros as in the past. They have prevented the euro from depreciating more rapidly… but they are unlikely to stop its depreciation.’ ” The implication is clear: the Euro is facing (passive) pressure on multiple fronts. In fact, the kinds of back-and-forth swings that have become commonplace in forex markets may be attributable to large-scale investors, such as Central Banks. As currencies (or other securities, for that matter) decline, investors will often take advantage of low prices and enter the market. When prices rise, these same investors (joined by long-term investors) will often take profits and sell. As a result, it is hard for currencies to rally continuously without any kind of correction. While it’s true that the average daily turnover of the global forex markets now exceeds $4 Trillion, the majority of this represents the rapid opening and closing of positions by the same group of traders. Only a small portion of this actually represents meaningful changes in portfolio allocation. Thus, when the SNB or the Central Bank of China buys or sells €15 Billion, it can seriously alter the course of the Euro, even though it would seem to represent an insubstantial portion of trading volume. Thus, market participants (especially amateurs) are advised to watch these market movers for signs of changes in their respective portfolios, because they will often signal the direction of the market. For example, from 2002 to 2009, “The euro’s weighting in global reserves rose to 28% from 23%, according to International Monetary Fund data,” and over the same time period, the Euro rose 50% against the US Dollar. It’s possible that the Euro’s appreciation drove Central Bank purchases of the Euro, rather than the other way around. The truth is probably that the two trends reinforced each other. Given that Central Bank reserves are once again rising, any changes in portfolio allocation could have significant implications for the forex markets.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment