Forex Blog |

| Intervention Looms as Yen Closes in on Record High Posted: 19 Aug 2010 11:02 PM PDT It was only a few weeks ago that I last wrote about the possibility of intervention on behalf of the Japanese Yen, and frankly, not a whole lot has changed since then. On the other hand, the Japanese Yen has continued to appreciate, the Japanese economy has continued to deteriorate, and the Bank of Japan has continued to ratchet up its rhetoric. In short, whereas intervention once loomed as a distant prospect, it has now become a very real possibility

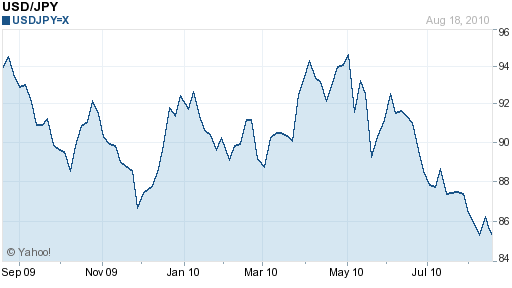

Last week, the Yen touched touched 84.73 (against the Dollar), the strongest level since July 1995. In the year-to-date, it has appreciated 10%. There are a handful of analysts, including the anointed Mr. Yen, who believe that the Yen will rise past its all-time high of 79.75, recorded in April 1995. At the same time, analysts caution that Yen strength is better interpreted as Dollar weakness, and that its overall performance is much less impressive: ” ‘Against a broader range of currencies, particularly in real terms, the yen is far less strong than it looks against the US$ in isolation.’ ” As the global economic recovery has faded, so has investor appetite for risk. The Japanese Yen has been a big winner (or loser, depending on your point of view) from this sudden sea change. Investors are dumping risky assets and piling back into low-yielding safe havens, like the Yen and the Franc. Ironically, the US Dollar has also benefited from this trend, but to a lesser extent than the Yen. It’s not entirely clear to me why this should be the case. As one analyst observed, “The zero-yielding currency of a heavily indebted, liquidity- and deflation-trapped economy should hardly be the go-to currency of the world.” At this point, it’s probably self-fulfilling as investors flock to the Yen instinctively any time there is panic in the markets. Some of the demand may be coming from Central Banks. The People’s Bank of China, for example, “has ramped up its stockpiling of yen this year, snapping up $5.3 billion worth of the currency in June, Japan’s Ministry of Finance reported Monday. China has already bought $20 billion worth of yen financial assets this year, almost five times as much as it did in the previous five years combined.” Given that “a one percentage point shift of China’s reserves into yen equals a month’s worth of Japan’s current account surplus,” it wouldn’t be a stretch to posit a connection between the Yen’s rise and China’s forex reserve “diversification.” Officially, China is trying to diversify its foreign exchange reserves away from the Dollar, but the Yen purchases also serve the ulterior end of making the Japanese export sector less competitive. In this sense it is succeeding, as the economic fundamentals underlying the Yen could hardly be any worse. “Real gross domestic product rose 0.4% in annualized terms in the April-June period, the slowest pace in three quarters…GDP grew 0.1% compared with the previous quarter.” This was well below analysts’ forecasts, and due primarily to a drop in consumption. Exports increased over the same period, causing the current account surplus to widen, but it wasn’t enough to prevent GDP growth from slowing. Meanwhile, unemployment is at a multi-year high, and deflation is threatening. With such persistent weakness, it’s no wonder that China has officially surpasses Japan as the world’s second largest economy.

The Yen is a convenient scapegoat for these troubles. The Japanese Finance Minister recently declared: “Excessive and disorderly moves in the currency market would negatively affect the stability of the economy and financial markets. Therefore, I am watching market moves with utmost attention.” It is rumored that the government has convened high level meetings to try to build support for intervention, such that it could apply political pressure on the Bank of Japan and cajole it into intervening. “With regard to problems such as the strong yen or deflation, we want to cooperate with the Bank of Japan more closely than ever before.” In the end, domestic politics are a paltry concern compared to the backlash that Japan would receive from the international community if it were to intervene: “Any U.S.-endorsed intervention would be interpreted in Beijing as hypocrisy. How can the U.S. criticize China for intervening in support of a weaker currency, Chinese officials would ask, while it does so itself in support of a weaker yen?” In other words, there is no way that any country would support the Bank of Japan because such would make it less likely that China would allow the Yuan to further appreciate. For this reason, many analysts still feel that the possibility of intervention is low. According to Morgan Stanley, however, there is now a 51% chance of intervention, based on its forex models. From where I’m sitting, it’s basically a numbers game. As the Yen rises, so does the possibility of intervention. The only question is how high it will need to appreciate before a 51% probability becomes a 100% certainty.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment