Forex Crunch OpenBook – A new social platform for eToro traders |

- OpenBook – A new social platform for eToro traders

- Make Your Life Easier By Trading The Higher Time Frames

- Forex Daily Outlook – July 12 2010

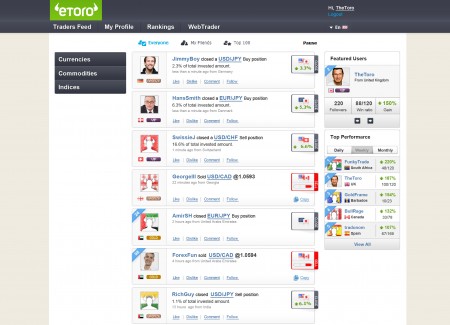

| OpenBook – A new social platform for eToro traders Posted: 12 Jul 2010 04:07 AM PDT eToro, a trading platform that emphasizes friendliness and simplicity, launched a social network for its traders. Here’s a review of OpenBook. Traders can opt in to share their trades with everybody or keep them to themselves. This is similar to Currensee’s sharing scheme. eToro’s simplicity is seen here – no option to share trades only to friends.

Users of this system can not only share their trades and connect to others, but also follow successful traders in real time, copying their moves. This could be good for those traders that don’t have enough time to trade and see forex as an investment. Yet again, OpenBook’s simplicity is sometimes too simple – the tools for finding those good traders aren’t very sophisticated – no risk factor, as Michael Greenberg writes in his review. Despite these shortcomings, and the fact that the platform is naturally limited to eToro traders only, this initiative is still great. The trades are shared on the web. Anyone can go to the site and see what’s going on without registering or opening an account. Many market-making brokers such as eToro rely on their traders to wipe out their accounts, and trade against them. By enabling traders to see others’ moves and especially follow them, there’s a potential for reducing the terrible loss ratio for forex accounts, meaning that eToro will indeed profit from spreads. The social forex scene is recently bubbling. FXBees recently joined Currensee. Everybody is going transparent these days, but the methods vary. I’ll review it later on this week. Ready to connect with real Forex traders? Currensee is the first Forex trading social network. |

| Make Your Life Easier By Trading The Higher Time Frames Posted: 11 Jul 2010 11:21 PM PDT Guest post from www.visionsofaffluence.com So many forex traders focus exclusively on short term fluctuations of the market and spend their time watching charts in an attempt to profit. They trade like this because they believe that it's the best way to profit in the forex market. But that couldn't be further from the truth. These traders are missing out on the power of the higher time frames in the forex market. The currencies of the world move in trends over the higher timeframes the same as they do over the smaller ones and if you open a trade in the right direction then you can set your self up for great returns without the stress and time commitment of the smaller timeframes. By higher timeframes I mean the daily charts and higher. Now I know you're probably thinking to yourself “but those high timeframes have less trading opportunities” and while that is true, it's not necessarily a bad thing. You see while the higher time frames give of fewer trades. The signals that they do give are more reliable so you are less likely to end up in a bad trade because of a false signal. Also the moves are larger which means that you will make more pips on the trades you do take. The real benefit of trading the higher timeframes though is that they don’t require the constant attention that the smaller timeframes demand. With the smaller timeframes you have to be at your computer for the duration of the trading session constantly waiting for a trade to present itself and then once you get into a trade you have to monitor it. With the higher timeframes you only have to check your charts at most once a day. If there is a trade then you take it and go ahead with the rest of your day and if there isn’t then you still go ahead with the rest of your day. There is no need to constantly monitor your charts. So, if you want to take the stress and time commitment out of your trading then I suggest you trade the higher timeframes. Try it you’ll be surprised by the difference it makes. |

| Forex Daily Outlook – July 12 2010 Posted: 11 Jul 2010 02:00 PM PDT We start the week with Britain Final GDP, Business Outlook Survey in the Bank of Canada, Chairman Ben Bernanke speech in Washington DC and more interesting news, let’s see what awaits us today. In the US, Federal Reserve Chairman Ben Bernanke; delivers a speech titled “Restoring the Flow of Credit to Small Business” at the Financing Needs of Small Business Forum, in Washington DC, and have an influence on the nation’s currency value.

Later in the US, Federal Open Market Committee (FOMC); Governor Elizabeth Duke delivers a speech titled “Small Business Credit: Next Steps” at the Financing Needs of Small Business Forum, in Washington DC; and affect the nation’s key interest rates and future monetary policy. Moving on to Canada, Bank of Canada (BOC) Business Outlook Survey of about 100 businesses examining the relative level of general business conditions, such as sales growth, investment in machinery, employment, inflation expectations, and credit conditions; a highly respected Survey related to the nation’s GDP. It’s a leading signal of future economic activity. For more on USD/CAD, read the Canadian dollar forecast. In Great Britain, Final Gross Domestic Product (GDP) stabilize on 0.3%, it’s the broadest measure of economic activity and the primary gauge of the economy’s health, that is released quarterly and measures the change in the inflation-adjusted value of all goods and services produced by the economy. More in Great Britain, Current Account shows a decrease of 2.6 Billion It’s directly linked to currency demand and to execute transactions in the country. Later in Great Britain, British Retail Consortium (BRC) Retail Sales Monitor leads the government-released retail data and has a narrower focus that includes retailers who belong to the BRC, shows a rise from -2.3% to 0.8% and measures change in the value of same-store sales at the retail level. Finally in Britain, Royal Institution of Chartered Surveyors (RICS) House Price Balance droops down by 2%, It’s a leading indicator that measures the level of a diffusion index based on surveyed property surveyors. Read more about the Pound in the GBP/USD forecast. In Australia, Home Loans rise up by 2.8%, it’s a leading indicator of demand in the housing market that measures the change in the number of new loans granted for owner-occupied homes; For more on the Aussie, read the AUD/USD forecast. In New Zealand, Food Price Index (FPI) shows a decrease of 0.2%, Although food is among the most volatile consumer price components, this indicator garners some attention because New Zealand’s major inflation data is released on a quarterly basis. In Japan, the Corporate Goods Price Index (CGPI) rises up by 0.2% it’s a leading indicator of consumer inflation that Measures the Change in the price of goods sold by corporations; That’s it for today. Happy forex trading! Want to see what other traders are doing in real accounts? Check out Currensee. It's free. |

| You are subscribed to email updates from Forex Crunch To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment