Forex Blog |

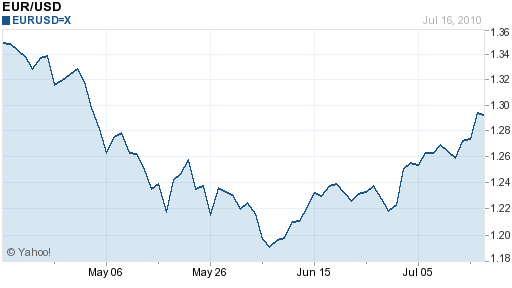

| Euro Rally: Temporary or Permanent? Posted: 17 Jul 2010 08:28 AM PDT Since the beginning of June, the Euro has rallied by an impressive 8% against the US Dollar, and by comparable margins against other currencies. The question on every one’s minds, of course, is whether this represents a temporary pullback or a permanent correction.

Due to its sudden rise, the Euro became a much less attractive funding currency for carry traders. It helps that other Central Banks are delaying interest rate hikes, which means it’s difficult to turn a solid profit (on a risk-adjusted basis) from shorting the Euro. In addition, the markets have started to turn their attention to economic fundamentals in the US, which had been edging out the Euro in one of the perennially important rivalries in currency markets. In short, it suddenly became obvious to traders that the economic and fiscal conditions in the US are at best equal to those in the EU. Finally, there was an implicit acknowledgement among the EU leadership that the so-called sovereign debt crisis is actually in many ways a banking crisis. This admission came in the form of stress-tests on 91 of the EU’s largest banks, designed to determine their exposure to sovereign debt and placate investors. After all, “It was German and French banks that led the way in lending to Greece or Spain.” This misjudgement has spurred such banks to set aside Billions in potential losses and vastly curtail their lending activities. Unfortunately, investors are skeptical that the stress tests will be stringent enough, seeing them as a mere publicity stunt: “While the EU have tried to counter these suspicions by promising to publish the result of stress tests, the market is fearful that stress tests will force some banks into writing down losses on non-performing loans.” By extension, investors are still equally concerned about the possibility of a sovereign debt default, even one that it is only partial. In other words, the consensus is that despite the EU’s best efforts to tackle the crisis, it still has yet to enact meaningful structural reforms, opting instead for short-term stopgap solutions. According to The Economist, “The debate about how to save Europe's single currency from disintegration is stuck…because the euro zone's dominant powers, France and Germany, agree on the need for greater harmonisation within the euro zone, but disagree about what to harmonise.” There remains a lack of agreement over whether the economically and fiscally weaker members of the EU will be allowed to remain members, and if so, what if anything will be done to keep them in line.

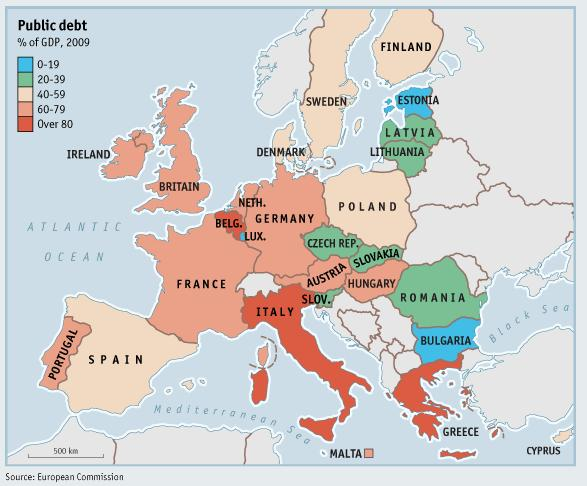

As you can see from the chart above, time is quickly running out. For the majority of EU countries, debt is now rising faster than GDP. From the standpoint of many investors, default seems like the most likely outcome since such countries lack the political muster to reduce their budget deficits, nor can they devalue their debt through currency depreciation, due to the common currency. Thus, the consensus (for now) is that the Euro’s run will soon come to an end. According to Citigroup, “The euro will resume its decline and head toward the $1.10-$1.15 range. ‘The market has digested a lot of the bad news about the euro. There’s no great optimism.’ ” Meanwhile, BNP Paribas “expects the euro to fall to parity by the end of 2010—one euro per dollar—a level it hasn’t seen since December 2002…[and] drift to 97 cents before hitting bottom in the third quarter of 2011.”  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment