Forex Blog |

| New Zealand Dollar Thriving in Obscurity Posted: 08 Jul 2010 10:18 PM PDT It’s understandable that forex investors basically ignore New Zealand. Its economy is around 10% the size of its neighbor Australia, its currency is less liquid, and spreads are higher. Given that its performance closely tracks the Australian Dollar, meanwhile, why pay it any attention?

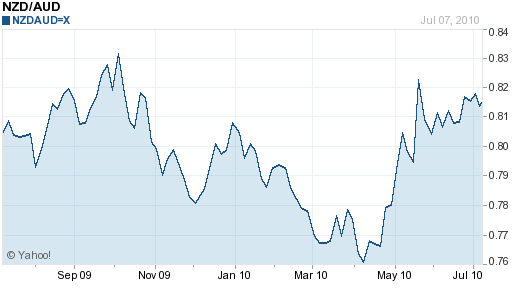

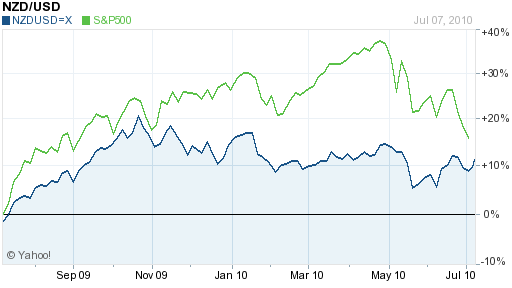

To be sure, the new currencies from Down Under trade in virtual lockstep, having strayed by only a few cents in either direction from their trading mean over the last year. Since the beginning of May, however, the Kiwi has staged an impressive rally, rising 8% against the Aussie in a matter of weeks. Perhaps, there is something worth analyzing after all! According to most analysts, the sudden rise is largely a product of risk-appetite. Specifically, as the EU sovereign debt crisis stalls, investors are relaxing, and gradually moving capital back into growth currencies, like the New Zealand Dollar. In fact, the Kiwi recently rose to a one-month high on the same day that Spain successfully completed a bond auction. For proof of this phenomenon, one need look no further than the close relationship between the NZD/USD rate and US stocks, as proxied by the S&P 500. You can see from the chart below that they have largely tracked each other over the last 12 months. This relationship seems to have intensified over the last few weeks, as the New Zealand Dollar sometimes takes its cues directly from releases of US economic data.

However, New Zealand economic fundamentals are also playing a role, perhaps even the dominant role. According to one analyst, “The NZ dollar had now recovered nearly all its losses of late May…Domestic fundamentals had contributed relatively more to the NZ dollar’s recent recovery than had the mild improvement in the global backdrop.” Unlike Australia, which has been racked by political disruptions and concerns over an economic slowdown by its largest trade partner (China), New Zealand continues to coast at a healthy pace. Moody’s forecasts that New Zealand’s economy will expand by 2.4% in 2010, and “assuming a healthy global economy, New Zealand’s recovery should evolve into a self-sustaining expansion during 2011 and 2012.” This should set the stage for near-term rate hikes, beginning with an expected 25 basis point hike on July 29. Analysts project that the benchmark rate will reach 3.75% by the end of 2010, and 5% in 2011. Widening interest rate differentials, combined with the ongoing recovery in risk appetite, could turn the Kiwi into a popular carry trade currency. Given that the Central Bank of Australia is also projected to further hike rates, it seems the Aussie will join the Kiwi in its upward march, and that the two currencies will continue to trade in lockstep. Options traders might try to construct a low volatility strategy, such as a short straddle or selling covered calls against the pair. For currency traders that prefer the Aussie, meanwhile, the New Zealand Dollar could serve as an attractive hedge. Then again, it’s possible that both currencies could fade, especially if the EU debt crisis intensifies, and/or the global economic recovery stalls. In short, “The near-term outlook is…uncertain due to prevailing risk aversion that may weigh on the commodity currency universe.”  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment