Forex Blog |

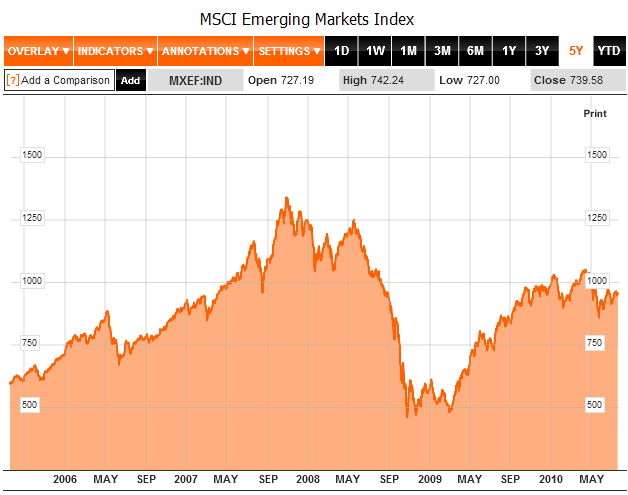

| Emerging Markets Continue to Shine Posted: 21 Jul 2010 03:54 AM PDT After a slight respite following the culmination of the Eurozone debt crisis, emerging markets financial markets are back to the their former selves, with stocks, bonds, and currencies all performing well. The rally is being driven by two principal factors. First, investors came to the gradual realization that the trend towards risk aversion had reached extreme proportions. Given that the crisis in the EU has been fairly limited both in scope and extent (at least so far), it made little sense to punish emerging markets. If anything, emerging markets should have been the financial safe havens: “Debt-to-GDP ratios in the developed world are about double those in emerging markets, and they’re growing. This makes emerging markets interesting because you’re picking up incremental spread and in return you’re actually taking less macroeconomic risk.” Other analysts see a certain futility in targeting a risk-averse strategy: “It’s not that people suddenly think emerging markets are a lot safer, it’s that they’re realising risk is everywhere and they can’t just assume the developed world is safe.” In other words, some investors are wondering whether it doesn’t make sense to focus less on risk – which has become increasingly random – and more on return. In this aspect, emerging market investments of all kinds are more attractive than their counterparts in the developed world. The second source of momentum for the rally is a long-term shift in capital allocation. Thanks to foreign demand, Emerging Market “borrowers, including governments and companies, have raised almost $300bn (£200bn) to date, up 10 per cent on the same period in 2009.” A microcosm of this surge can be seen in US mutual funds: “Emerging market equity funds…posted combined inflows of more than $3 billion for the week ended July 14, while emerging market bond funds took in $745 million, bringing their year-to-date inflows to an all-time high of $18.5 billion.” Across all sectors, money is pouring into emerging markets at an even faster pace than before the credit crisis. This time around, however, analysts argue that it is justified by fundamentals: “Economies in the developing world are slated to grow 6.3% this year and are expected to maintain a similar growth rate through 2013, according to the International Monetary Fund. Advanced economies are seen expanding around 2.4% annually over the same time period.” The Brazilian economy alone expanded at an annualized rate of 9% in 2010 Q1, the fastest rate in 15 years! Emerging market investors share the confidence of foreign investors, and it seems the flow of funds will primarily be one-way. According to a recent survey, “Just 19 per cent of Brazilians, 15 per cent of Indians and 11 per cent of Chinese…said they anticipated increasing cross-border investment.”

|

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment