Forex Blog |

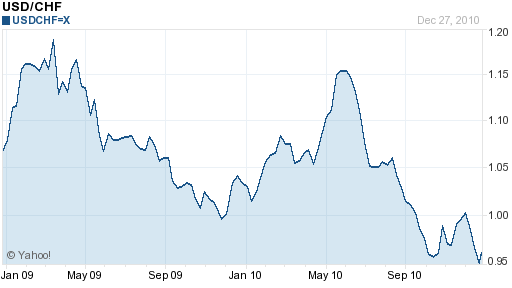

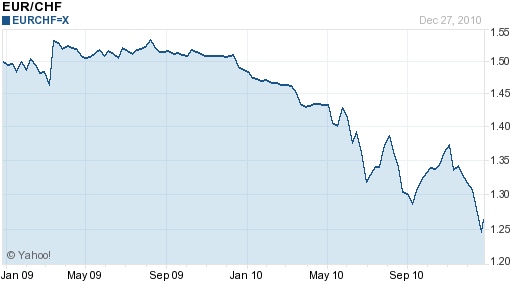

| Swiss Franc Surges to Record High(s) Posted: 28 Dec 2010 11:20 PM PST In the last two weeks, the Swiss Franc rose to record highs against not one, but two major currencies: the US Dollar and the Euro. The Franc is now entrenched well above parity against the former, and is closing in on the magical level of 1:1 against the latter. With market uncertainty projected to run well into 2011, continued strength in the Franc is all but assured.

The Franc’s rise is due entirely to its being perceived as a safe haven currency. Its debt levels are comparable to other industrialized countries, its economy is in mediocre shape, and interest rates are the lowest in the entire world (the overnight lending rate is a paltry .1%). Some analysts have cited the “strong Swiss economic outlook” and “the health of Swiss public finances” as two factors buttressing its strength, but make not mistake: if not for the tide of risk aversion sweeping through the world’s financial markets, the Franc would hardly be attracting any attention. As I have reported recently, the Dollar and the Yen have also benefited from the spike of risk aversion caused by renewed concerns over the fiscal health of the EU and the prospect of conflict in Korea. Perhaps owning to nothing more than proximity, the Franc has been the primary beneficiary from EU sovereign debt crisis. “It appears that smart money investors are pre-emptively bailing funds out of the eurozone with Switzerland providing a safe port to ride out the eurozone sovereign debt storm that appears to loom on the horizon,” summarized one analyst. Unfortunately, it looks like the situation in the EU can only become serious. Despite a collective move towards fiscal austerity, all of the problem countries are still running budget deficits. As a result, members of the EU are set to issue no less than €500 Billion of new debt in 2011. To make matters worse, “The onslaught of credit warnings and downgrades of sovereign ratings over the past few days added to worries that borrowing costs in many euro zone nations could rise further.” This could trigger a self-fulfilling descent towards default and further buoy the Franc.

At this point, the main variable the Swiss National Bank (SNB), which could resume intervention on behalf of the Franc. After spending close to €200 Billion to depress the Franc, the SNB accepted the futility of its efforts and formally renounced intervention in June. However, Swiss National Bank President Philipp Hildebrand recently referred to the Franc’s rise as a “burden,” and warned that the SNB “would take the measures necessary to ensure price stability” in the event of “renewed financial market tensions.” As to whether intervention is likely, analysts remain divided. “The timing [for intervention] would certainly be perfect, with liquidity very thin….pre-holiday markets are ideal for springing a surprise,” said one strategist. According to Morgan Stanley, however, the SNB is “unlikely to intervene in the near term to stem the rise in the franc. The previous intervention earlier this year has left a huge overhang of liquidity in the economy and the Swiss National Bank doesn’t want to further boost the money supply.” In addition, the SNB experienced losses of €22 Billion on its forex reserves in the first nine months of this year, and will be reluctant to incur further losses by resuming intervention. In short, aside from this lone point of uncertainty, all factors point to continued upside.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment