Forex Blog |

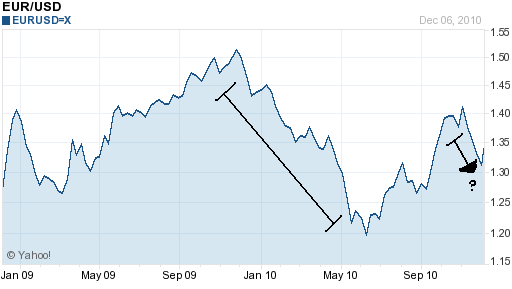

| Risk Aversion (Still) Positive for USD Posted: 07 Dec 2010 06:33 AM PST As one strategist recently put it, we seem to be witnessing Deja Vu in the forex markets. The US Dollar in general, and the USD/EUR currency pair in particular, are behaving exactly the same as one year ago: “The greenback rose back then…on a combination of strong U.S. November jobs numbers…and the triple downgrades of Greece later in the month by Fitch, S&P and Moodys.” This time around, a similar combination of US optimism and EU pessimism are once again buoying the Dollar.

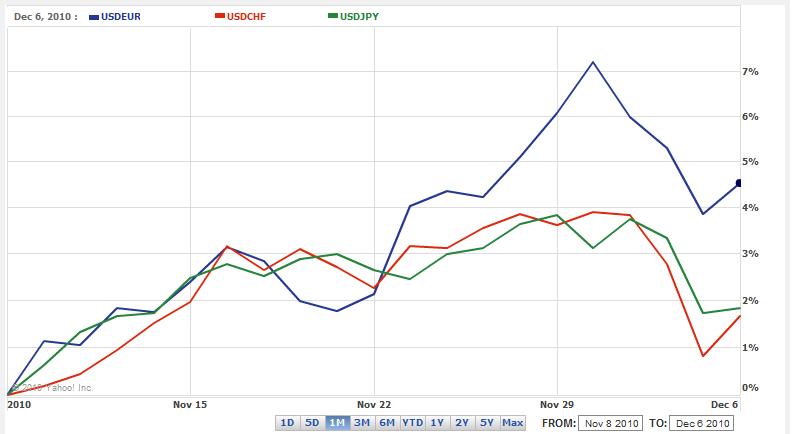

The skirmish between North and South Korea further added to the climate of heightened risk, and reinforced the position of the Dollar as the world’s safest currency, ahead of even the Swiss Franc and Japanese Yen: “Recent events just reinforce the underlying message that during times of turmoil, almost no matter what the source, the U.S. dollar is seen as a safe harbor for investors.” Basically, there is still nothing that can compare to US Treasury securities in terms of liquidity and security. In fact, demand for Dollars has become so acute in recent weeks that some analysts are already bracing for the (still-distant) possibility of another Dollar shortage, like the one that plagued the markets following the collapse of Lehman Brothers in 2008. In short, “The strong dollar thirst linked to dollar-funding needs is, as usual, supporting the dollar.” Meanwhile, the markets are becoming less pessimistic about the impact of the Fed’s $600 Billion expansion of its Quantitative Easing Program (QE2) and consequently more optimistic about US growth prospects. Even before the drama in the EU and Korea, investors had already started to adjust their positions. Since mid-October, “Futures traders have slashed bets for a decline in the dollar against the euro, yen, Australian dollar, and Swiss franc, data from the U.S. Commodity Futures Trading Assn. show…Strategist forecasts for the dollar to weaken have all but disappeared.” While the employment picture remains a dim spot, the economy is still growing. In a recent televised interview, Ben Bernanke declared that, “Another recession appeared unlikely.” He also added that QE3 is also a possibility if banks continue to hoard capital, eroding the effectiveness of QE2. The positive reaction of forex markets shows that investors are less concerned about inflation and more focused on whether QE2 will facilitate economic growth. It “absolutely can be dollar-positive if the markets decide that [it is] going to be part of the package that brings about a revival in economic growth,” summarized one analyst.

|

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment