Forex Blog |

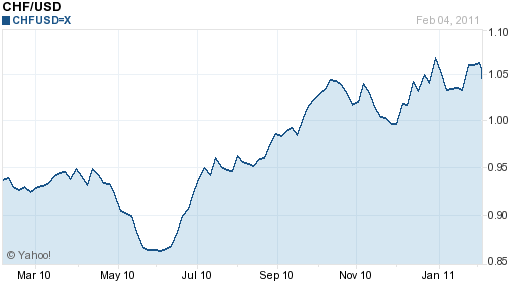

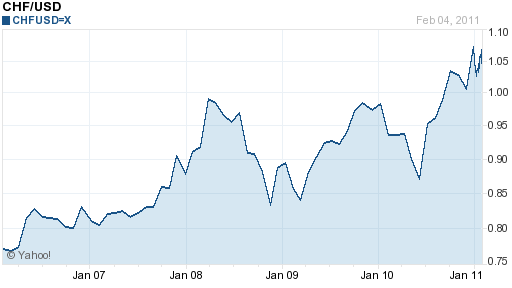

| Has the Swiss Franc Reached its Limit? Posted: 06 Feb 2011 05:26 AM PST The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and has become a favored destination for investors looking for a safer alternative to the Euro. Still, there are reasons to wary, and it could be only a matter of time before the CHF bull market comes to a screeching halt.

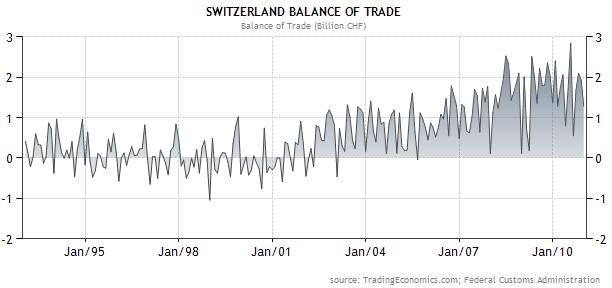

Even an abatement in the EU storm has failed to produce a Swiss Franc correction. That could be because the bad news coming out of Europe seems to be never-ending; one country’s rescue is followed by the downgrade of another country’s sovereign credit rating and warning of imminent collapse. In addition, even as investors have embraced risk-taking, they still remain prone to sudden backtracking. Thus, the Franc has been one of the primary targets of risk-averse capital fleeing the Egyptian political turmoil. Capital controls and intervention have scared investors away from some currencies, but the Swiss National Bank (SNB) lacks the credibility afforded to other Central Banks. The SNB lost $25 Billion in 2010 in a vain effort to hold down the Franc, and currency investors believe that it has neither the stomach nor the mandate to engage in a similar loss-making campaign in 2011. Besides, the Swiss economy has held up remarkably well, and the trade surplus has actually widened in the face of currency appreciation. The markets might be keen to test the limits of the Swiss export sector, in much the same way that they have challenged Japan by pushing up the Yen.

Of course in the short-term, it’s possible that a handful of risk-averse investors will continue to steer capital towards Switzerland, and/or that another mini political or economic crisis will trigger a spike in risk-aversion. When investors once again look at fundamentals, they will be forced to reckon with the Franc’s 40% appreciation over the last five years, and probably conclude that perhaps it was a bit much…  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment