Forex Blog |

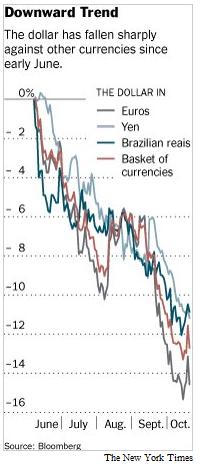

| Currency War Will End in Tears Posted: 08 Nov 2010 01:46 AM PST The “currency war” is heating up, and all parties are pinning their hopes on the G20 summit in South Korea. However, this is reason to believe that the meeting will fail to achieve anything in this regard, and that the cycle of “Beggar-thy-Neighbor” currency devaluations will continue. There have been a handful of developments since the my last analysis of the currency war. First of all, more Central Banks (and hence, more currencies) are now affected. In the last week, Argentina pledged to continue its interventions into 2011, while Taiwan, and India – among other less prominent countries – have hinted towards imminent involvement. Of greater significance was the official expansion of the Fed’s Quantitative Easing Program (QE2), which at $600 Billion, will dwarf the efforts of all other Central Banks. In fact, it’s somewhat ironic that the Fed is the only Central Bank that doesn’t see its monetary easing as a form of currency intervention when you consider its impact on the Dollar and its (inadvertent?) role in “intensifying the currency war.” According to Chinese officials, “The continued and drastic U.S. dollar depreciation recently has led countries including Japan, South Korea and Thailand to intervene in the currency market,” while the Japanese Prime Minister recently accused the U.S. of pursuing a “weak-dollar policy.”

As of now, there is no indication that other industrialized countries will follow suit, though given concerns that QE2 “at the end of the day might be dampening the recovery of the euro area,” I think it’s too early to rule anything out. While the Bank of Japan similarly has stayed out of the market since its massive intervention in October, Finance Minister Yoshihiko Noda recently declared that, “I think the [Yen's] moves yesterday were a bit one-sided. I will continue to closely monitor these moves with great interest.” As the war reaches a climax of sorts, everyone is waiting with baited breath to see what will come out of the G20 Summit. Unfortunately, the G20 failed to achieve anything substantive at last month’s Meeting of Finance Ministers and Central Bank Governors, and there is little reason to believe that this month’s meeting will be any different. In addition, the G20 is not a rule-making body like the WTO or IMF, and it has no intrinsic authority to stop participating nations from devaluing their currencies. Conference host South Korea has lamely pointed out that while ” ‘There aren’t any legal obligations‘…discussion among G20 countries would produce ‘a peer-pressure kind of effect on these countries’ that violated the deal.” Not to mention that the G20 will have no effect on the weak Dollar nor on the undervalued RMB, both of which are at the root of the currency war. It’s really just wishful thinking that countries will come to their senses and realize that currency devaluation is self-defeating. In the end, the only thing that will stop them from intervening is to accept the futility of it: “The history of capital controls is that they don't work in controlling foreign exchange rates.” This time around will prove to be no different, “particularly with banks already said to be offering derivatives products to get around the new taxes.” The only exception is China, which is only able to prevent the rise of the RMB because of strict controls for dealing with the inflow of capital. In short, the “wall of money” that is pouring into emerging market economies represents a force too great to be countered by individual Central Banks. The returns offered by investing in emerging markets (even ignoring currency appreciation) are so much greater than in industrialized countries that investors will not be deterred and will only work harder to find ways around them. Ironically, to the extent that controls limit the supply of capital and boost returns, they will probably drive additional capital inflows. The more successful they are, the more they will fail. And that’s something that no new currency agreement can change.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment