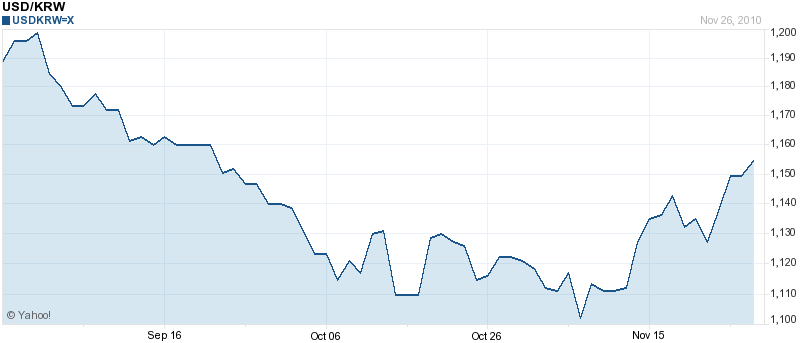

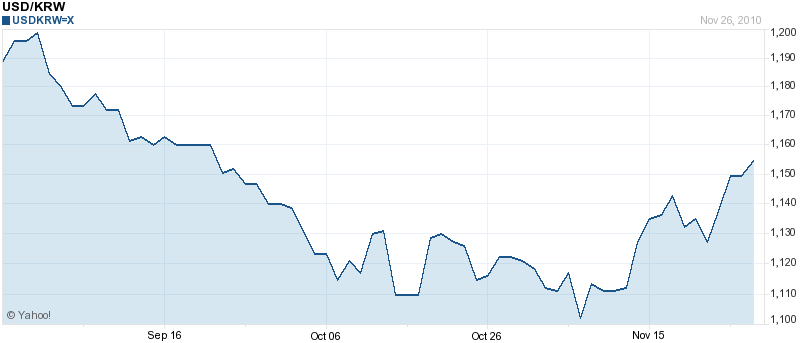

South Korea was in the midst of figuring out what to do with its appreciating Won when disaster struck, in the form of an unprovoked attack from North Korea. Combined with a worsening of the sovereign debt crisis in Europe, the news was enough to send the Won down 5% over the course of a couple weeks. From the standpoint of managing its currency, it looks like the (distant) prospect of war is actually a blessing in disguise.

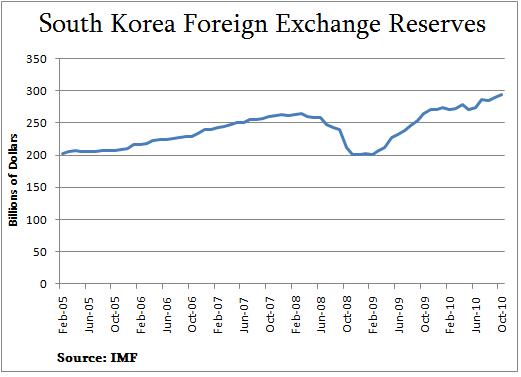

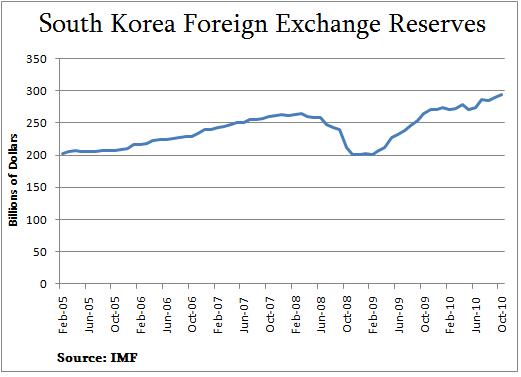

Over the last decade, South Korea has been one of the world’s largest serial interveners in currency markets. Over the last two years alone, as evidenced by the growth in its foreign exchange reserves, it has spent more than $100 Billion defending the Won. As the so-called currency war has intensified, so, too has the Bank of Korea intensified its efforts to hold down the Won, having spent more than $20 Billion since July towards this effort.

You could say then that South Korea’s hosting of the G20 Summit on November 15 put it in a slightly awkward position. Still, it was determined to make clear that it would continue to take steps to combat the rise in the Won. According to Shin Hyun-song, the special economic advisor to President Lee Myung-bak, “This means that countries can intervene in the currency market when the market is in disorder and when there is a gap between the market rate and underlying economic fundamentals.” Of course, fundamentals is hardly an objective notion in this case.

While the G20 predictably called on participants to “move toward a market-driven exchange rate system and to refrain from competitive devaluations,” it nonetheless also guided them towards “implementing policy tools for bringing excessive external imbalances down to sustainable levels.” The underlying message is that certain countries should curtail their reliance on exports and try to achieve more balanced growth.

Naturally, South Korea’s interpretation was that while direct intervention is now taboo, taxes and other capital controls are sanctioned. Thus, it has been reported that “the Korean government has been gauging its timing to launch further measures to tighten the financial market and protect it from volatile global capital movement..bank levies on non-deposit liabilities and taxes on foreign purchases of government bonds are both possible options.”

As I said, though, the South Korea now has some breathing room. Its Won depreciated rapidly in the minutes after the shelling of Yeonpyeong island, which killed four and wounded 20, was first reported. The fact that the US government immediately pledged its support and solidarity (by sending over an aircraft carrier) is not instilling confidence. One analyst indicated, “We see a strong chance of further Korean won weakness in the days ahead as more details emerge, particularly if public opinion in South Korea puts pressure on the government there to take a stronger stance.”

Even before this episode, the EU sovereign debt crisis had spread to Ireland, and put Spain and Portugal at risk, too. As a result, the Dollar-as-safe-haven mindset re-emerged, and spurred some capital movement back to the US. In this context, the drama with North Korea only exacerbated the climate of risk aversion.

Ultimately, both the EU fiscal crisis and the tensions with North Korea will subside, which should cause the Won to resume its rise. (In fact, Korean exporters have come to view this as inevitable, and have taken advantage of the relatively favorable exchange rate to repatriate overseas earnings). At this point, you can expect the Bank of Korea to begin implementing capital controls and continue the face-off with currency markets.