Forex Blog |

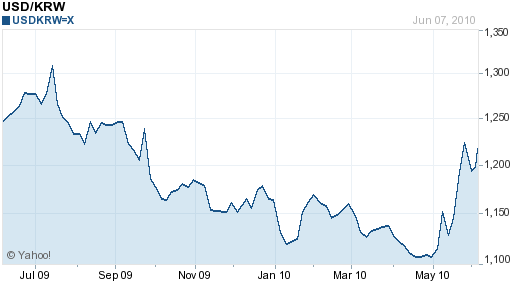

| Posted: 08 Jun 2010 12:34 AM PDT The South Korean Won has been one of the biggest losers from the EU sovereign debt crisis. After a stellar 2009, the Won is off to a shaky start in 2010, and has lost 12% of its value in the last month alone. According to analysts, The won is “most sensitive to risk aversion” of any currency in Asia – or even the world. Thus, when the President of Hungary likened his country’s fiscal situation to that of Greece and inadvertently ignited fears that the crisis was spreading, the Korean Won immediately fell by 5% – the largest decline in 17 months.

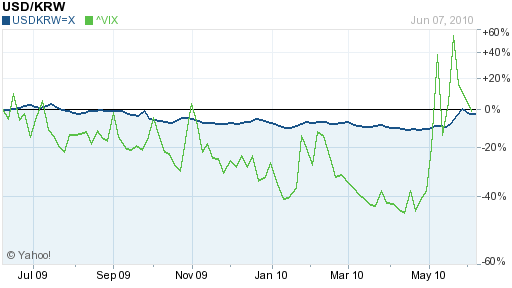

To elaborate, South Korea’s short-term foreign currency debt is extremely high (60% of foreign exchange reserves). That’s primarily due to Korean exporters’ hedging activities, which for risk management purposes, need to be offset by short-term borrowing by banks in the money market. Since this debt needs to be rolled over frequently, South Korea is especially vulnerable to liquidity crunches. In fact, the Won has been called a “VIX currency,” since it tends to fall when volatility (proxied by the VIX index) rises. Hence, the Won lost 50% of its value during the peak of the credit crisis, and has already declined 10% this time around.

There are also a handful of market analysts who attribute the Won’s fall to the ongoing conflict with North Korea. In response to the sinking of a warship in March, South Korea has responded by imposing trade sanctions on North Korea, which in turn has responded with threats of “all-out war.” From a forex standpoint, “The largest concern is that the cutting off of economic links raises the risk of a sudden regime collapse, resulting in the South facing a huge influx of refugees. This would have a significant — and possibly prolonged — impact on the Korean won.” How should one proceed? If indeed you believe that the Won is being harmed by the prospect of conflict with North Korea, you might be inclined to agree with the notion that, “The recent sell-off in the won has been overdone and should correct, assuming that the North-South tensions will ease in the months ahead.” In fact, if war is avoided, the current bear market could be an excellent buying opportunity, and the Won could still be on track to rise to 1,100 USD/KRW by year-end, conforming to analysts’ median expectations. On the other hand, if you believe that the Won’s woes are largely attributable to the EU fiscal crisis, there is very little reason to hold the Won, since that crisis will probably only get worse before it gets better: “The Korean market was precariously positioned, with high multiples, above-trend earnings, heavy positioning towards risk and ominous technicals suggesting little sponsorship for strength.” In this case, the Won could easily fall to 1,300 – or worse – before the year is out. In any event, South Korea will host a meeting of the G20 this week, which should yield more clarity into what the rest of 2010 has in store for the Won.  |

| You are subscribed to email updates from Forex Blog To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 20 West Kinzie, Chicago IL USA 60610 | |

No comments:

Post a Comment